The view of humanity’s energy supply and use presented last week painted a picture in the most abstract terms. The aggregate figures discussed there can be viewed as an attempt to describe all significant economic activity by means of a single quantitative measure. Such efforts may well have a familiar tone—in a sense, the data that the IEA provides in energy terms is a physical-world analogue to the financial-world perspective provided by bodies such as the Organisation for Economic Co-operation and Development (OECD)—the IEA’s parent inter-governmental body—when it measures global economic activity in terms of Gross Domestic Product, or GDP. In this sense, we could view the 510 EJ total primary energy supply (TPES), and 350 EJ total final consumption (TFC) in 2009 as the energetic equivalent of saying that in 2009, global aggregate GDP was around US$60 trillion.

It’s increasingly common now to hear arguments that the financial view of economic activity is excessively abstract in failing to account for the physical economy’s reliance on ‘natural resources’ and ‘bio-physical services’ that are subject to finite or otherwise limited stocks and flows. Let me be clear before we continue that I find views along these lines—exemplified by classic works such as Limits to Growth and E.F. Schumacher’s Small is Beautiful, and more recent articulations such as John Michael Greer’s The Wealth of Nature, and Charles Hall and Kent Klitgaard’s Energy and the Wealth of Nations: Understanding the Biophysical Economy—to be credible, uncontroversial [Note 1] and very much illuminating. The case for GDP providing an inadequate measure of economic performance is pretty well established. Its inadequacy as a measure of ‘social wellbeing’ is also widely recognised, as reflected for instance in the adoption by the Australian Bureau of Statistics of a wide range of additional indicators in measuring what it refers to as national progress (it’s worth reflecting on the extent to which the ABS’s framing of its alternative approach in such terms suggests an ongoing alignment with the worldview in which GDP rose to prominence as an index of ‘social wellbeing’ in the first place). One significant critique of GDP is that it in fact fails to account for a great deal of economic activity, and in doing so, contributes to a culture of marginalisation with respect to the activity that’s overlooked. So for instance, the time that my partner, Shelly, and I spend caring for our two pre-school age sons, Orlando and Asher, adds nothing to GDP, and in fact can be framed as reducing GDP via the opportunity cost of paid work that we might otherwise have contributed to the formal economy. If we placed Orlando and Asher in full-time childcare to allow both of us to work nine-to-five jobs, then not only would GDP increase by the amount of our paid labour, it would also increase with the amount paid by us to the childcare provider. A compelling argument can be made that a focus on GDP as the default measure of economic performance encourages a social climate in which work is regarded as more legitimate if it’s carried out in exchange for money, than if it’s motivated, say, by love. Such an outcome might well be regarded as rather perverse.

So how far might an economic view based on physical performance measures including energy supply and use, rather than monetary performance measures alone, go to addressing such a situation? That we should bring our economic thinking into alignment with the biophysical foundations on which all human activity depends seems clear to me. What is not so clear, though, is that energy-based economic analysis would necessarily lead to the improvements for which its proponents might hope. Why this hesitation? This stems from views along the lines that “GDP is an empty abstraction devoid of any link to the real world”, or that economic thinking based on monetary foundations is excessively abstract in general. It’s not the particular content of such views that I’m questioning here. What concerns me is that we might replace one abstraction—let’s just call it money—with the apparently more concrete but in fact highly abstract concept of energy. As I laid out in detail in the foundational posts, the energy concept, while being about our physical world, entails dealing with that most fundamental aspect of our world in terms that nonetheless involve a very high degree of abstraction. We could argue at length about whether an economics based on abstract financial concepts involves a greater or lesser degree of abstraction than an economics based on abstract energetic concepts, and would quite likely end up no less illuminated than when we started. My point here is just that we would be better off recognising that any conceptual system we use to make sense of the world necessarily entails abstraction, and the more general we want that system to be, the greater the degree of abstraction it will entail.

This isn’t to say that we should not or cannot differentiate effectively between abstractions that approach economic activity from a monetary perspective and those approaching it from an energy perspective—we just need a slightly more nuanced basis for this. The approach that I propose for this is to recognise that each of these abstractions relates to what we might characterise as different levels of reality associated with any situation that we’re considering in economic terms—the physical level in the case of energy, and the socio-cultural level in the case of money. By referring to different levels of reality here, I have in mind the view from the systems sciences in which physical, biological and socio-cultural phenomena are differentiated on the basis of their relative evolutionary emergence: socio-cultural phenomena are characterised by processes that are emergent from and not reducible to biological phenomena; biological phenomena are characterised by processes that are emergent from and not reducible to physical phenomena. This allows for a view in which socio-cultural and biological-level phenomena are fundamentally dependent on physical-level phenomena, without implying that the higher-level phenomena can be explained in terms of—or reduced to—the lower-level phenomena. A more detailed introduction to such a view is available in this article, specifically section 3, ‘An introduction to Integral Sustainability: the nature of reality’, pp.61-3.

On the basis of this view, it isn’t the level of reality that we’re dealing with per se that determines the degree of conceptual abstraction involved: we can characterise any such level with a greater or lesser degree of abstraction, depending on the degree of local contextual nuance we see as necessary for making sense of the situation we’re dealing with. But all conceptualising by its nature entails abstraction. A central tenet of Beyond this Brief Anomaly’s view is that, rather than trying to turn away from abstraction altogether, finding ways of living well in the face of the major societal dilemmas confronting us will require that we become more skilful in matching the degrees of abstraction on which our conceptual tools are based with the immediate situations at hand.

Last week, I pointed out that the IEA’s global aggregate figures for energy supply and use only include quantities recognised as contributing to the formal economy, and for which appropriate official accounting systems are available. In this respect, the IEA energy data has much in common with the financial data provided by bodies such as the OECD. In fact, the omission of energy associated with passive heating of buildings or line drying of clothes from the official figures could be seen as equivalent to the omission from GDP of the unpaid work related to our ‘home lives’. In both instances, the adage ‘what gets measured, matters’—and its corollary, ‘what doesn’t get measured doesn’t matter’, comes to mind. With this as background, I’ll focus for the remainder of this post on the first stage of building up a more comprehensive picture of what lies beneath the global aggregate energy supply and use figures, in effect winding back some of the abstraction process that led to that easily digested but not particularly informative account.

In a very rough sense, by bringing a little more context to those highly abstract figures this post represents a microcosm of the overall inquiry. If I was to summarise it in the most concise terms, I could say that our inquiry is all about increasing sensitivity to the contexts within which energy concepts have developed, and within which we understand and use them. My motivation for doing this is that it might better ensure that those concepts act as our servants and not our masters as we work out how to live in relation to the situations in which we, as citizens of fossil-fuelled industrial civilisation, find ourselves.

Returning to earth: heading towards a context-sensitive view of world energy supply and use

The first step that we’ll take is to differentiate TPES into its principal components, and get some sense of how these have changed over time. The figure below from the IEA presents global TPES for the period 1971 to 2009:

World TPES, 1971-2009. Source: International Energy Agency, accessed 1 May 2012 at http://www.iea.org/stats/pdf_graphs/29TPES.pdf.

Perhaps the most obvious feature of this data set is the extent to which the aggregate supply is dominated by fossil energy sources—coal, oil and natural gas comprise a little under 10,000 Mtoe (million tonnes of oil equivalent, c.f. units last week i.e. thousand tonnes of oil equivalent) in 2009 out of a total that’s a little over 12,000 Mtoe. In other words, around 80 percent, as noted in Beyond this Brief Anomaly’s opening post. This proportion is down a little over the data period, from around 87 percent in the early nineteen seventies; as the chart makes clear though, this isn’t due to other sources displacing fossil sources—it’s simply a result of those other sources growing a little more rapidly than coal, oil and natural gas combined. A large chunk of the difference is due to the nuclear energy component, which grew significantly in the nineteen seventies and eighties, but has remained more-or-less constant in magnitude for more than a decade now. From Beyond this Brief Anomaly‘s systemic perspective, the overall dominance of global energy supply by fossil sources has highly significant implications. Considered in systemic terms, our overall global economic story needs to be considered in the context of the energy supply story that the IEA data presents. As I pointed out last week, current human activity—along with the lifestyle expectations that underpin this—is enabled not simply by joules of energy, but by tonnes of coal, barrels of oil and cubic metres of natural gas. To this we must of course add kilograms of uranium oxide, gigalitres of rainfall runoff and tonnes of vegetation—but as the IEA chart literally depicts, these are all underwritten by fossil energy sources. The implication of this is that all economic activity is necessarily subsidised by these fossil sources. They play a fundamental role in shaping every aspect of our present industrial societies. In a sense, we can say that our world is currently shaped in their image. This doesn’t mean that human societies cannot exist without them—clearly, we humans made do just fine without them for millennia prior to the Industrial Revolution. It does imply though that it might be prudent to imagine that future worlds dependent on and hence shaped principally by renewable sources will likely be markedly different from what we’re familiar with today.

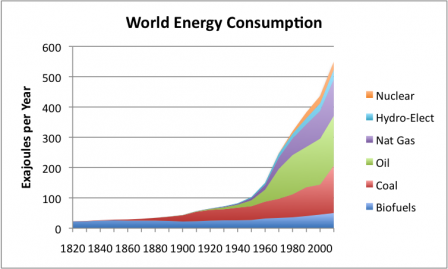

The story presented in the IEA data is foreshortened by the focus on relatively recent history. This is in fact a reflection of the IEA’s own history—the agency having been established in 1973. Placing our present energy supply situation within a temporal context that spans most of the industrial age provides a heightened appreciation for the significance of coal, oil and natural gas. The figure below, created by Gail Tverberg based on data from Vaclav Smil, clearly supports the justification for characterising ours as the fossil fuel age:

World primary energy supply by source, 1820 to present. (Original caption “World Energy Consumption by Source, Based on Vaclav Smil estimates from Energy Transitions: History, Requirements and Prospects together with BP Statistical Data for 1965 and subsequent”). Source: Gail Tverberg, ‘World Energy Consumption Since 1820 in Charts’, Figure 1, Our Finite World, March 12 2012, accessed 7 May 2012 at http://ourfiniteworld.com/2012/03/12/world-energy-consumption-since-1820-in-charts/.

While the chart is titled world energy consumption, it’s clear from the scale on the vertical axis that the data lines up with what we’ve been referring to as total production. There’s no confusion here—this simply reflects the difference in perspective between a supply-centric and a demand-centric view i.e. whether we treat the aggregate flow of energy sources as an output from what Greer—extending Schumacher’s idea of primary and secondary economic goods—terms the primary economy (or the nature’s economy), or an input to the secondary economy (the human economy of goods and services produced with inputs from the natural world). Despite the data series starting close to the end of the historical period typically referred to as the Industrial Revolution (in Europe at least), the role of coal relative to biofuels is barely discernible at that time. So the figure does indeed capture the entire span of the industrial age, at least to the extent that this can be characterised in terms of fossil fuel use. Perhaps the most significant feature to note here is the extremely rapid growth in oil production between 1945 and 1970—accounting for most of the post-Second World War energy boom—followed by an equally significant decline in the rate of growth after that time. On this basis, we can now see that the IEA chart coincides with a period in which growth in oil production has been slowing, up until the present time where production has effectively reached a plateau. We’ll be focusing on this in more detail as we proceed, as it’s central to the observation here at Beyond this Brief Anomaly that as a global society we are entering a period of major energy-related challenges.

Returning now to our focus on the IEA data, another significant observation is that the chart clearly places the popular narrative of ‘energy decoupled’ and ‘decarbonised’ economic activity into its proper context. While in terms of GDP per unit of energy supply and per unit of carbon emission such trends are indeed playing out, this is all in the context of net growth in both energy supply and related emissions. We can also see that the data doesn’t support the idea that more carbon-intensive fossil sources (coals) are progressively being displaced by less carbon-intensive fossil sources (at first oil, and later gas). While new fossil sources have been introduced over the course of the industrial age, this has involved adding new sources to the existing base, rather than replacing any part of that base. Each of the fossil sources has undergone continuous production expansion since its initial introduction into the mix.

The chart illustrates the scale of the task involved for ‘direct conversion’ renewable sources—geothermal, solar, wind—to significantly displace fossil sources, let alone replace them altogether. Due to the way that renewables are accounted for, the renewable component on the above chart is a measure of final energy output, rather than primary geothermal, solar or wind energy input. Considering this, comparison of fossil sources and renewables on a final consumption basis provides a more accurate picture of their relative scales than comparing them on the basis of primary supply. Even so, to the extent that whole-of-economy-scale transitions to renewable sources are typically envisaged in terms of massively expanded solar thermal electricity generation relative to photovoltaic and wind generation, primary supply provides a relevant indication of the scale of such transition. While renewables are undergoing very high rates of growth, the chart illustrates the small base from which they are starting, and gives some sense of the gulf in scale between fossil and renewable sources.

While the breakdown between key primary sources provided in the chart gives a much more nuanced picture of the supply situation than the single aggregate figure with which we started, we come now to the question of what the chart leaves hidden from view. This is very significant, as the data presented here provides what is probably the most easily accessible depiction of global energy use—and hence of what the global economy looks like in physical terms. Not only is the data itself reproduced extensively and used as a key input to decision making—the format in which it’s presented is also widely taken to be representative of what we in fact need in order to understand energy use, and hence plays a key role in influencing how energy use is understood by individuals and organisations around the world. The first thing to note in this respect is the different physical nature of the sources that are presented here as equivalent to one another. As mentioned last week, we can see this even in terms of the basic forms of matter for the fossil sources—solids, liquids and gases are all presented as equivalent, despite their obvious incompatibility in terms of the infrastructural and institutional arrangements by which we obtain and use them to fuel human economic activity. In certain applications, there’s certainly scope to substitute one source for another, but this requires that the systems through which the energy associated with each source is made available to us be modified accordingly—requiring, for instance, appropriate technological changes, developments in know-how, and financial investment. The differences in physical forms amongst the various sources—and even differences in the underlying physical phenomena underpinning the energy associated with them—are greater still in relation to the non-fossil sources, which span a spectrum from uranium-based nuclear fuels to water stored in dams. The incompatibilities between primary sources are mitigated to a significant degree for the end user by standardisation of final energy supply forms—i.e. fuels and electricity, which we’ll look at in more detail shortly. Electricity production is, from an energy use perspective, particularly significant in this respect. Even so, from an energy supply perspective, the central issue is hopefully clear: if the electricity production infrastructure that I wish to fuel is a nuclear power plant, then the energy associated with water stored in a nearby dam is of little practical relevance to me.

Attending to the differences between each of the major source categories provides some significant insight into the very limited equivalence entailed by characterising them on the basis of an associated heating value. This issue is not restricted to differences between the major categories though—it extends to the aggregation of components within the categories also. Consider, for instance, the coal category: as indicated on the figure, this is in fact coal and peat. Peat, consisting of partially decomposed plant matter, is essentially a very young form of coal—or to put it a little more accurately, a substance that represents an early stage in the potential formation of coal (should the peat remain undisturbed under appropriate conditions for a sufficiently long time!). The coal/peat source category spans a spectrum of materials from peat through to anthracite, the highest grade of coal characterised by its relatively hard, dense material form and shiny black appearance. To put this in an energetic context, the difference in heating values between peat and anthracite covers a range of around 600 percent. We’ll look at the specifics of this in an upcoming post.

We find similar situations with each of the major categories. Oil is a particular case in point. This category includes a range of sources from the free-flowing light crude oil characteristic of the original ‘gushers’ in Pennsylvania and Texas, and today’s major Middle East oil fields, to Canadian tar sands that are mined by dredges or excavators and heated in order to make liquid hydrocarbons—the family of chemicals with which the energy we’re actually interested in is associated (and another topic for more detailed consideration in a subsequent post)—available for refining. That we really are dealing with multiple quite distinct materials under these aggregate categories is practically demonstrated by the fact that many of them are traded in their own markets, attracting different prices and with different supply and demand dynamics due to the need to match source compositions with refinery capabilities, transport infrastructure for refinery feedstocks and fuel products, and access to fuel markets. It’s apparent from this that the aggregation of sources under broad common categories is a matter of accounting convenience, rather than an accurate representation of economic compatibility and substitutability.

The next point to note is the most significant in relation to Beyond this Brief Anomaly’s inquiry into the ways of life that might be open to us in a world where human activity is fuelled by renewable energy sources. The aggregation of distinctly different sources on the basis of nominal heating value provides us with no indication of i) the wide range of costs incurred in obtaining those sources and ii) the costs that are incurred in making the energy associated with the sources available to us in the forms that we actually want i.e. the costs associated with using the energy sources to bring about the physical effects that we desire. There is a broad class of costs relating to i) and ii) that we typically consider in energetic terms. Last week I made brief mention of two very important conceptual approaches to understanding these: energy return on energy invested (EROI); and availability (widely approached now under the banner of exergy analysis). As we proceed, we’ll look at the energy costs of our energy use in much greater detail under the overarching theme of efficiency.

The convention—by which the IEA data and most national accounts are characterised—of thinking about energy use in terms of a two-tier model comprising primary supply and final consumption does provide some limited insight into the energy cost of energy use. As we saw last week, on the basis of these figures we can make broad observations about overall conversion efficiency from primary sources to fuels and electricity. Even so, this is far from a comprehensive account of the economics of energy supply and use. Moving beyond this limited perspective via concepts such as EROI and exergy will be tremendously important if we’re to develop economic thinking better matched to the great challenges we face as we shift from what Greer has called “abundance industrialism” to “scarcity industrialism”. Developing better understanding of the economic costs omitted in the IEA data should be a high priority.

Dealing with economic costs alone, however, still won’t provide us with the degree of nuance that we need for making adequate sense of our societal situations in energy terms. For this we need to add in costs that, for the sake of convenience, we can refer to broadly as ‘environmental’ and ‘social’. I say ‘for the sake of convenience’ because I don’t wish to reify any of these three cost categories—I’m simply treating them as more-or-less useful lenses through which any situation can be inspected in order to highlight features that might otherwise be overlooked. We’ll be much better off if we hold this three-fold differentiation lightly, making sure that it serves more comprehensive sense making rather than dictating how we think about the situations we’re interested in. The article that I linked to earlier in the post in relation to the discussion on levels of reality also deals with this in more detail.

As with economic costs, the associated environmental and social costs vary greatly in nature and magnitude, both across the range of energy source categories and amongst the different components of which each is comprised. Many of these costs are interwoven—as we see for instance in relation to the growth in production of unconventional natural gas (i.e. shale gas in the United States, and coal seam gas in Australia). In Australia, the recent rapid growth of this industry is having very significant impacts on rural farmlands and communities—it might perhaps be most meaningful to characterise these as ‘enviro-socio-economic’ in nature i.e. they entail comprehensive changes to relations amongst the human and non-human worlds. As the inquiry proceeds I’ll sweep in considerations relating to these broader cost categories as is appropriate, but I’ll generally avoid drawing sharp categorical lines between economic, social and environmental costs. For now, the key point that I’m hoping to bring home is that despite the fact that we can draw an energetic equivalence between the major energy source categories included in the IEA’s TPES data, in almost every other respect significant for understanding their roles in the global economy, the various energy sources differ markedly from one another, and hence are equivalent only in the most abstract sense.

To round out this post, I’ll spend a little time now unpacking the IEA data on total final consumption for the world over the same period—see the figure below:

World TFC, 1971-2009. Source: International Energy Agency, Key World Energy Statistics, ‘World final energy consumption for 1971 to 2009 by fuel (Mtoe)’, p.28, accessed 7 May 2012 at http://www.iea.org/textbase/nppdf/free/2011/key_world_energy_stats.pdf.

This figure provides us with a view of the means by which energy supply is distributed throughout the global economy. In this respect, the TFC chart provides a handy depiction of global economic activity in energetic terms. We can see in this figure the quantities of energy associated with each of the major classes of final energy carrier. The TFC picture is dominated by the oil component, mainly comprising our major transport fuels: marine diesel fuel, automotive diesel fuel, automotive gasoline and aviation turbine fuel. On the basis of this view, we might at first glance assume that transport fuels account for a larger proportion of the global economy’s ‘work and heating task’ than is actually the case. As with the TPES chart though, this presentation of the data hides from view the energy costs of energy use. When comparing transport fuels with electricity and heating fuels, this is highly significant. The activity enabled by transport fuels always involves conversion of heat to work via some form of heat engine, and as discussed previously, this necessarily entails a large proportion of the heat input from combustion of the fuel being lost as heat output to the engine’s surrounds. Electric motors on the other hand convert electrical energy to mechanical work output with far higher efficiency; and where fuels are burnt to provide heat directly, it’s also possible to do so with relatively high efficiency. If we shift our focus from the fuel or electricity input to the economically valuable processes in which we’re interested to the valuable effects brought about by those processes, then the relative contributions of oil, electricity and natural gas are closer in magnitude than the TFC chart suggests.

The issue of end-use incompatibility, highlighted in relation to the TPES components, is also highly relevant here—in fact, perhaps even more so. This is particularly pronounced with respect to the role of oil-based fuels in transport. While the proportion of the overall ‘work and heating task’ enabled by oil-derived fuels is over-represented by oil’s share of TFC, oil does in fact have a disproportionately important economic role overall, due to its domination of the overall transport task. Globally, transport accounts for around 25 percent of TFC. While around 60 percent of all oil use in OECD countries is for transport, the share of the global transport task that uses oil-derived fuels directly is in the order of 95 percent. Most of the remaining 5 percent is accounted for by electrified rail transport. While this statistical view is compelling, if we focus on the numbers alone we might miss the central insight in all of this: every aspect of our industrial economy is thoroughly dependent on mechanised transport. The viability of non-transport related components of our economic activity must be considered in the context of the transport components, and hence is fundamentally dependent on oil-based fuels just as much as is the transport sector. I’m well aware that this effectively amounts to saying ‘all aspects of our economic activity are interdependent’. Nonetheless, our economic reliance on mechanised transport, and our transport reliance on oil, bears particular emphasis in thinking about the prospects for post-fossil energy societies.

Following from this, the final observation I’ll make before wrapping up this post is that the aggregation of final energy carriers—fuels and electricity—on the basis of nominal heating values does not reflect the differences in utility value that end users attribute to each TFC component. This is a similar issue to that highlighted in relation to TPES, where the operators of an electricity generation plant or a fuel refinery are interested not in the availability of generic energy sources, but in the specific fuels and feed stocks that their plant requires in order to produce saleable products. Here, we’re looking at this issue not from the point of view of energy suppliers, but from the perspective of energy users. There’s much talk now of transforming national economies or even the global economy as a whole to run largely on electricity, and hence to be based, from the end user perspective, on a single generic energy carrier. Should we expect to make such a transition though without changing the expectations that we hold for such a transformed economy, in terms of the ways of life that it enables? With respect to the role of mechanised transport in the global economy, the extent to which our current infrastructures and institutions are not only dependent on but have in fact evolved in the context of fossil-fuelled internal combustion engines, should give us some pause for thought.

In an upcoming post I’ll focus specifically on fossil fuels, and draw out the particular characteristics that make them so economically valuable—and that in turn have such a pronounced impact on the nature of our present economic arrangements. Before doing that though, there’s another rather important contextual dimension that needs discussing as we develop a more comprehensive understanding of the relationships between human activity, the ways we live, and energy use. We’ve now moved some way towards better appreciating the need to think about energy supply and use in term of specific fuels and their particular characteristics—the actual sources with which the energy that we use is associated—and not just in term of joules—the abstract quantity associated with these sources to describe their nominal capacity to effect physical changes. While we’ve brought some nuance to the overall global picture in terms of the major sources that make up energy supply and use, this has still been in terms of an aggregate picture for the world as a whole. This view omits the very uneven distribution of that energy supply and use amongst us, the people whose lives are being ‘aggregated’ in those figures. Next week, I’ll attempt to bring a little more nuance to that aspect of the picture.

Notes

Note 1: This isn’t to say that such views, especially as articulated in the more prominent examples I offer here, are not the subject of controversy—rather, I’m saying here that in my view the basis of such controversy doesn’t seem to be well founded.

Pingback: The economic view of systemic efficiency: energy return on energy investment | Beyond this Brief Anomaly

Pingback: EROI and the limits of conventional feasibility assessment—Part 1: The technical potential for renewables | Beyond this Brief Anomaly